The first coins ever invented were probably stamped ingots of electrum, a mixture of gold and silver, created by the Lydians, a people of Asia Minor, in about 650BC. The most famous Lydian was King Croesus who introduced pure gold coins and was the inspiration behind the expression as rich as Croesus. Will you become as rich as Croesus yourself if you invest in coins? With careful planning the answer could well be in the affirmative. Because according to specialists, Noble Investments, long-term coin collections spanning a period of 50 years or more have achieved compound annual returns of 8.7% – 10.5% a year which certainly matches or betters just about every major stock market in the world. Furthermore, short-term performance has also been strong. A random portfolio of gold and silver coins selected from Spinks auction catalogue in 2000 would have shown a compound annual return of 12%.

There is plenty of other evidence to suggest that coins would currently make an addition to any investment portfolio. Investment-quality coins are in the early stages of a long-awaited major upswing.

investors have responded to recent stock market declines and geo-political strife by retreating to safe-haven assets, including metals. Collectable coins should demand even higher premiums because they are in such short supply.

The coin market is both global and relatively liquid. A rare coin is easy to store and transport plus it can be sold quickly and inexpensively anywhere in the world thanks to a plethora of collectors, dealers, auction houses. Also the internet something which cannot be said of many alternative investments; added to which there is the pleasure of collecting something of intrinsic interest.

Numismatics offers a fascinating link with the past and offers an excuse to study everything from history to economics and from theology to metallurgy. Coins are an art form, too. It is generally considered that the masterpieces of the coin world were produced in the Greek colony of Sicily in the fifth and fourth centuries BC. Take a silver decadrachm struck in Syracuse in around 400BC. The work of Euainetos, its obverse features a fast quadriga driven by a female charioteer. The sense of speed is achieved by two of the horses slightly rearing and the hooves all of which are above the ground forming a jagged broken pattern. A coin such as this is, frankly, a thing of great beauty as well as of great value.

What sort of coins should you invest in to optimise returns?

There are two approaches to take.

The first is to diversify buying the best examples you can afford across a wide range of different categories. Everything from Ancient Greek Coinage to modern commemorative sets. The benefit of this strategy is that the value of your collection will not be vulnerable to the vagaries of fashion. On the other hand, it is not necessarily as interesting as specialising in one or more areas and you may miss out on the spectacular growth which can be achieved with a little speculative foresight. For example, up until the late 1970s, little attention was paid to the intriguing Islamic coinages of the Middle East. Arabs themselves were not attracted to their past coinage and consequently the market for Islamic coins was confined to a small band of dedicated scholars and collectors. However, all this altered when Arabs developed a growing awareness of their cultural heritage and began to form collections of numismatic treasures.

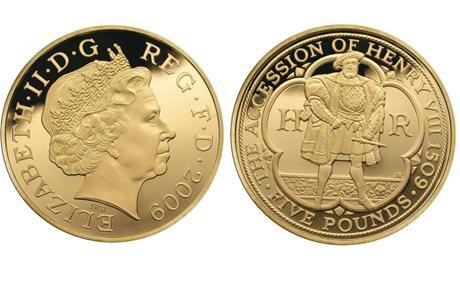

Should you decide to build up a collection you could do so by choosing a theme (such as coins featuring a particular animal); a type (the technical term for a main design of coin, issued in a particular country, state or region); a denomination (such as gold sovereigns); a ruler (collecting an example of a coin from each reign of an emperor, king or queen); or commemoratives (in coins that were or are struck to celebrate particular events).

You should always buy the best example you can afford. The commercial value of any coin depends on four factors:

1. Its exact design, legend, mintmark or date

2. Its exact state of preservation

3. The demand for it in the market at any given time

4. The availability of similar coins in the market at that time.

Interestingly, the appearance on the market of newly-discovered examples of a coin or of a long-held private collection seems to have the effect of pushing prices up. Even though the supply of available coins has been increased at a stroke, demand rises proportionately more. This situation has become more noticeable in recent years, emphasising that quality coins are becoming more difficult to find. The market has never experienced a state of saturation on the disposal of a quality collection‚ which is good news for investors.

Prices tend to be highest in country of origin, which means if you search overseas you may find better deals especially where the pound is stronger than the local currency. Do, however, be cautious about buying from individuals or over the internet. Better to pay slightly more and know you are investing in the genuine article.