Investing in Rare Coins

Why not go one better than gold bullion and look at rare coins as an investment medium? You can do this directly, through building up an investment-grade collection yourself, or short circuit the process by buying a ready-made coin collection through a fund that’s already listed and backed by some of the biggest names in the investment world.

Like stamps, rare coins are a classic collectable item. Coin collecting is a well established hobby. Using rare coins as an investment medium is becoming more widespread.

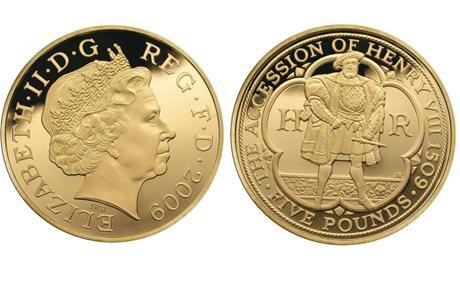

A good starting point is to look at the distinction between rare coins and bullion coins. Bullion coins, like krugerrands, have a value that solely reflects the weight of bullion they contain.

A good starting point is to look at the distinction between rare coins and bullion coins. Bullion coins, like krugerrands, have a value that solely reflects the weight of bullion they contain.

Collectable coins, by contrast, have a value that depends on their scarcity and condition. Prices are set independently by investors and collectors. This happens mainly through the auction market and a network of coin dealers. So, while some rare coins are of gold or silver, they do not depend on the bullion price for their value.

Picking good rare coins that are likely to increase in value in the future is an art. It is not that different from being a successful investor in stocks and shares.

Investing in rare coins: Why invest in rare coins

Here are a few reasons why you should consider rare coins as an investment medium:

Scarcity

The rarest collectable coins exist only in very limited quantities. Own a rare item in first-rate condition and you have a reasonable chance that its value will increase in the future. The value of a rare coin is set by demand from the collector and investor base. Although hoards of coins occasionally come to light, supply is normally strictly limited. And unlike stock market investments, there are no right issues, share placings, management bust-ups, frauds, profit warnings and any of the other risks that can affect a share’s value.

Consistent long-term returns

Collectable British coins have performed well in recent years. The seminal event for coin investors was the sale of the Slaney collection at Spink in May 2003. This sale set a new world record for an auction of English silver coins. The 285 lots in the auction sold for around £1m. Some 50 of the coins bought in the 1940s and 1950s at a total cost of £2,350 fetched £460,000, almost 200 times their original cost.

The prime example was the very rare Charles II “Pattern Crown”, bought in 1950 for £450. It was sold, 53 years later, for £138,000, almost three times the pre-sale estimate.

And the Slaney sale wasn’t an isolated example. Returns of this size have been confirmed by results from subsequent major coin sales. They also compare well with the returns from other collectables like stamps and rare books. While it’s hard to make comparisons, long-term returns from rare coins seem to be in low double-figure percentages.

And the Slaney sale wasn’t an isolated example. Returns of this size have been confirmed by results from subsequent major coin sales. They also compare well with the returns from other collectables like stamps and rare books. While it’s hard to make comparisons, long-term returns from rare coins seem to be in low double-figure percentages.

Diversification

While the stock market may have generated slightly better returns than coins over the years, share prices have been much more volatile. Arguably shares have more risk. Coin values reflect the spending power of those who want to put money into rare coins. Like the stock market, this depends on economic prosperity. Coins are an attractive form of diversification away from shares. Many also find the tangible nature of coins reassuring.

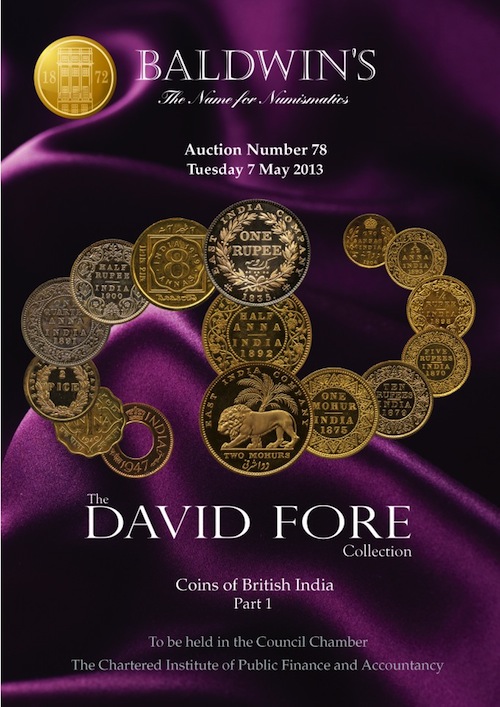

An honest, transparent market

Coins are bought and sold through a network of dealers. Some specialise in particular aspects of the coin market. Coins are also bought and sold at coin fairs and auctions. It is a global market not dominated by any one player. So it is an honest market. Values are set by supply and demand. Auctions set a reference point for prices. There is widely disseminated information on prices and well-documented historical price trends for almost every type of coin.

Global in scope

There are collectors of, and investors in rare coins in most markets of the world. Many start off by investing in the rare coins of their own country, or those of a particular historical period. So whether it is coins of the English Civil War period, Georgian golden guineas, Islamic coins, or Ancient Greek and Roman pieces, there is an active market to suit the interests of most collectors and investors.

Investing in rare coins: How do you get started?

If you want to be a hands-on numismatist, picking items yourself and assembling a collection then there are a few rules you need to observe.

One is that, not unlike the stock market, it’s a good idea to specialise and to pick an area you know about. In coins, this might mean a geographical area or a historical period. The second point to remember is that assembling a collection means buying the very best pieces you can afford. In this context, “best” means those pieces in tip-top condition and the real rarities.

You can buy coins at auction, but until you become a confident investor, the best route is a trusted dealer with whom you build up a relationship and who can keep a weather eye open for the type of material you want.

If this all sounds a little like too much hard work, there is a solution: buy shares in a listed fund that uses expert help to invest in a wide-ranging portfolio of investment grade coins.